Understanding the basics of wealth management is crucial for securing your financial future, regardless of your current income level. This guide will provide essential knowledge on key concepts including budgeting, investing, saving, retirement planning, and risk management, empowering you to make informed decisions about your money and build long-term financial security. Learn how to navigate the complexities of wealth creation and preservation with actionable strategies for financial success.

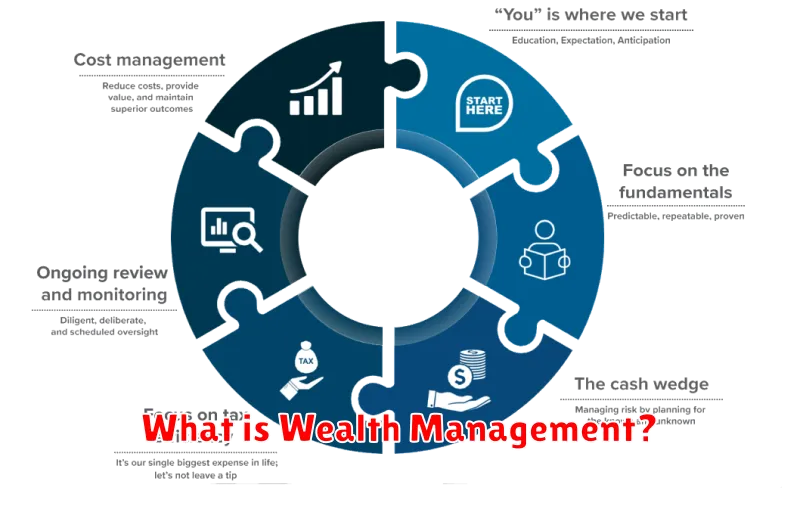

What is Wealth Management?

Wealth management is a comprehensive financial planning service designed to help individuals and families achieve their long-term financial goals. It goes beyond simple investment management, encompassing a holistic approach to financial well-being.

Key aspects typically included are: financial planning, investment management, tax planning, estate planning, and risk management. A wealth manager acts as a financial advisor, coordinating these services to create a personalized strategy tailored to the client’s specific needs and circumstances.

The ultimate aim of wealth management is to grow and preserve wealth while aligning financial strategies with an individual’s lifestyle, values, and objectives. This may include retirement planning, education funding, or charitable giving, among other goals.

How to Set Realistic Wealth Goals

Setting realistic wealth goals is crucial for achieving financial success. It requires a clear understanding of your current financial situation and future aspirations. Begin by assessing your current income, expenses, and assets. This provides a baseline for determining achievable targets.

Next, define your financial goals. Are you saving for retirement, a down payment on a house, or your children’s education? Be specific. Instead of “become wealthy,” aim for “accumulate $500,000 in retirement savings by age 65.” This allows for measurable progress.

Consider your time horizon. Long-term goals (retirement) require different strategies than short-term goals (a new car). Factor in inflation and potential market fluctuations when projecting future wealth.

It’s essential to be realistic. Your goals should be challenging yet attainable. Avoid setting overly ambitious targets that can lead to discouragement. Regularly review and adjust your goals as your circumstances change. A financial advisor can provide valuable guidance in setting and achieving your financial objectives.

Finally, remember that wealth building is a journey, not a sprint. Consistent effort, disciplined saving, and smart investing are key to long-term financial success. Celebrate your milestones along the way to stay motivated.

Asset Allocation for Long-Term Growth

Asset allocation is a cornerstone of long-term wealth management. It involves strategically dividing your investments across different asset classes, such as stocks, bonds, and real estate, to optimize your portfolio’s risk and return profile.

A well-diversified portfolio reduces risk. By spreading your investments, you mitigate losses if one asset class underperforms. For example, if stocks decline, bonds might offer stability.

Your time horizon significantly impacts your asset allocation. Younger investors with longer time horizons can generally tolerate more risk and allocate a larger portion of their portfolio to stocks, which historically offer higher returns over the long term. Older investors nearing retirement typically prefer a more conservative approach with a greater allocation to bonds to protect their principal.

Risk tolerance is a personal factor. It’s crucial to choose an allocation strategy aligned with your comfort level with potential losses. A financial advisor can help you assess your risk tolerance and develop a suitable asset allocation plan.

Regularly rebalancing your portfolio is essential. As asset values fluctuate, your portfolio’s allocation can drift from your target. Rebalancing involves selling assets that have outperformed and buying those that have underperformed to maintain your desired asset mix.

Professional advice is valuable. A financial advisor can help you create a personalized asset allocation strategy tailored to your financial goals, risk tolerance, and time horizon. They can also monitor your portfolio and recommend adjustments as needed.

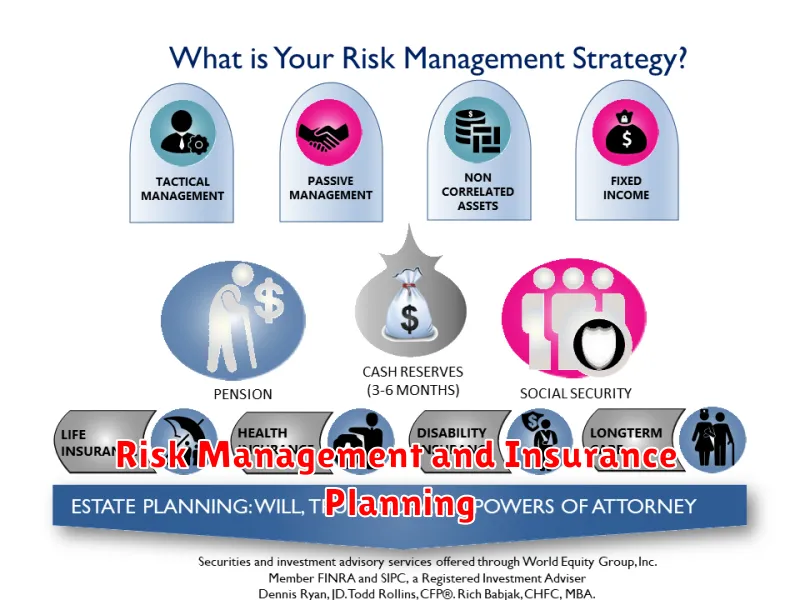

Risk Management and Insurance Planning

Risk management is a crucial component of wealth management. It involves identifying potential threats to your financial well-being, assessing their likelihood and potential impact, and developing strategies to mitigate those risks.

Insurance planning is a key risk mitigation strategy. Different types of insurance protect against various risks, such as: health insurance for medical expenses, life insurance to provide for dependents in the event of death, disability insurance for lost income due to injury or illness, and property insurance to cover damage to your home or belongings.

The appropriate level of insurance coverage depends on individual circumstances, including age, income, family size, and asset holdings. Diversification of insurance policies can help to comprehensively protect your assets and financial future.

Beyond insurance, other risk management strategies include diversifying investments to reduce the impact of market fluctuations, establishing an emergency fund to cover unexpected expenses, and creating a well-structured will to ensure your assets are distributed according to your wishes.

A thorough risk assessment and a well-defined risk management plan are essential for securing your financial future and achieving your wealth management goals. Consulting a financial advisor can provide personalized guidance on developing a comprehensive risk management and insurance strategy tailored to your specific needs.

Tax Strategies to Maximize Wealth

Effective tax planning is crucial for wealth maximization. Understanding your tax bracket and utilizing available deductions and credits can significantly reduce your tax liability. This allows you to retain more of your earnings and invest them for future growth.

Diversification of investments across different asset classes can help minimize your overall tax burden. For example, capital gains taxes on stocks can be offset by losses in other investments. Understanding the tax implications of various asset classes is paramount.

Tax-advantaged accounts, such as 401(k)s and IRAs, offer significant benefits. Contributions often reduce your taxable income in the present, and withdrawals in retirement may be taxed at a lower rate or be tax-free depending on the type of account. Proper utilization of these accounts is a key strategy.

Estate planning is essential for minimizing estate taxes and ensuring a smooth transfer of wealth to heirs. This involves creating a comprehensive estate plan that includes wills, trusts, and other legal instruments tailored to your specific circumstances. Professional advice is often recommended.

Tax-loss harvesting involves selling losing investments to offset capital gains, reducing your overall tax liability. This strategic move can be particularly beneficial for high-income earners.

Regular review of your tax strategy is vital. Tax laws change, and your financial situation evolves. Seeking professional advice from a qualified financial advisor and tax professional ensures your strategies remain optimal for your wealth growth.

Estate Planning and Wealth Transfer

Estate planning involves arranging for the management and distribution of your assets after your death. This crucial process ensures your wishes are followed regarding the distribution of your wealth to your beneficiaries and minimizes potential tax liabilities and family disputes.

Wealth transfer is the actual process of transferring assets, either during your lifetime (through gifting) or after your death (through your will or trust). Effective estate planning optimizes this transfer, considering factors such as taxes, probate, and the specific needs of your beneficiaries.

Key components of estate planning include creating a will or trust, establishing power of attorney for healthcare and finances, and designating beneficiaries for retirement accounts and life insurance policies. Consulting with a qualified estate planning attorney is essential to ensure your plan aligns with your goals and legal requirements.

Proper estate planning and wealth transfer strategies minimize estate taxes, reduce probate costs and time, and safeguard your family’s financial future. It is a proactive measure that ensures a smooth transition of assets and provides peace of mind.

Hiring a Financial Advisor: When and Why

Seeking professional financial guidance can significantly benefit your wealth management journey. The decision of when to hire a financial advisor is personal, depending on your individual circumstances and financial goals.

When to consider hiring a financial advisor includes situations such as: inheriting a significant sum of money, facing complex tax situations, planning for retirement, experiencing a major life change (marriage, divorce, birth of a child), or simply feeling overwhelmed managing your finances. Essentially, if you lack the time, expertise, or confidence to effectively manage your finances, professional assistance can be invaluable.

Why hire a financial advisor? They offer expert advice tailored to your unique needs, providing a personalized plan to achieve your financial objectives. They can help you make informed decisions about investments, retirement planning, tax optimization, estate planning, and risk management. A financial advisor acts as an objective, trusted partner, offering valuable insights and accountability to help you build and protect your wealth.

Ultimately, hiring a financial advisor is a strategic move that can significantly improve your financial well-being. The advantages far outweigh the cost for many individuals, particularly those navigating complex financial situations or seeking greater financial security.

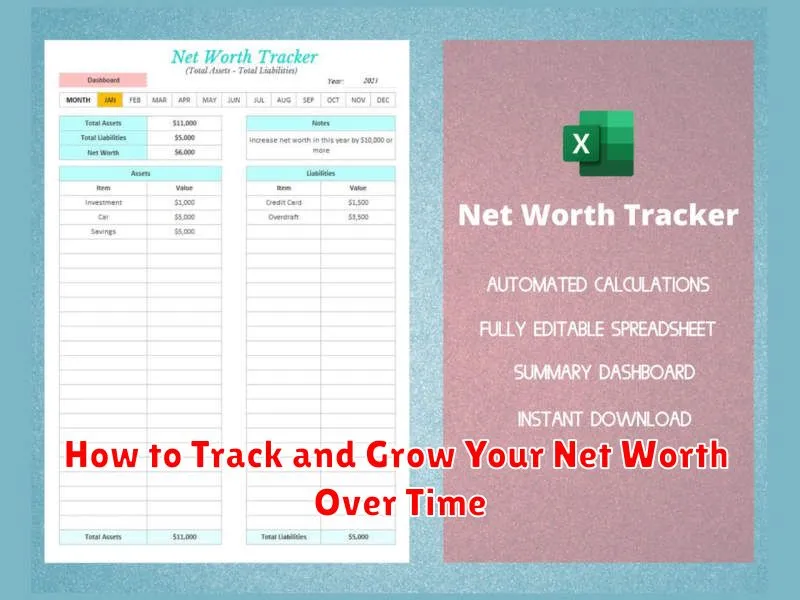

How to Track and Grow Your Net Worth Over Time

Tracking your net worth is a crucial first step in effective wealth management. Net worth is simply your assets (what you own) minus your liabilities (what you owe). To track it, create a simple spreadsheet or use budgeting software to list all your assets – including cash, investments, real estate, and personal property – and all your liabilities – such as mortgages, loans, and credit card debt.

Regularly update this spreadsheet (monthly is ideal) to reflect changes in asset values and debt balances. This allows you to see your progress over time and identify areas for improvement. Consider using a net worth calculator for assistance.

Growing your net worth involves a two-pronged approach: increasing your assets and decreasing your liabilities. To increase assets, focus on saving and investing. Explore various investment options like stocks, bonds, and real estate based on your risk tolerance and financial goals. Reducing liabilities involves paying down high-interest debt strategically, such as credit card debt, and making consistent payments on loans.

Consistent monitoring and adjustments to your spending and saving habits are key. Regularly reviewing your net worth statement provides valuable insights into your financial health and helps you make informed decisions to achieve your long-term financial goals. Consider seeking professional advice from a financial advisor for personalized guidance.