Are you struggling to make ends meet on a tight budget? Do you feel overwhelmed by the constant pressure to save money but unsure where to start? This comprehensive guide, “How to Save Money on a Tight Budget,” provides actionable strategies and practical tips to help you effectively manage your finances, reduce expenses, and achieve your financial goals, even with limited resources. Learn how to budget effectively, identify areas for potential savings, and cultivate money-saving habits that will transform your financial outlook.

Why Saving is Possible at Any Income Level

Saving money isn’t a luxury reserved for high earners; it’s a skill achievable at any income level. The key is prioritization and realistic goal setting. Even small, consistent savings add up over time, creating a significant financial cushion.

Effective budgeting is crucial. Tracking expenses reveals areas where spending can be reduced. This involves identifying non-essential expenses that can be cut back or eliminated entirely, freeing up funds for savings.

Adopting a mindset shift is also paramount. Focusing on needs over wants, and delaying gratification, can significantly impact your savings. The ability to save is not about the size of your income, but about your financial discipline and commitment to your savings goals.

Remember, saving is a journey, not a destination. Small, consistent steps, coupled with a realistic plan, will pave the way to achieving your financial goals, regardless of your income level.

Identifying and Cutting Hidden Expenses

Saving money on a tight budget requires identifying and eliminating hidden expenses. These are often overlooked costs that steadily drain your finances.

Start by carefully reviewing your bank statements and credit card bills for the past few months. Look for recurring charges you may have forgotten about, such as subscription services you no longer use, gym memberships you don’t attend, or automatic payments for products or services you’ve stopped needing.

Next, analyze your daily spending habits. Track small purchases like coffee, snacks, or impulse buys. These seemingly insignificant amounts can accumulate into substantial monthly expenses. Consider preparing your own coffee or lunch to reduce these costs.

Consider entertainment expenses. Explore free or low-cost alternatives to expensive outings. Look for discounts or free events in your community.

Finally, explore opportunities to reduce utility costs. Lower your thermostat, switch to energy-efficient light bulbs, and minimize water usage. These small changes can significantly impact your overall budget.

By diligently identifying and cutting these hidden expenses, you can free up valuable funds and create more financial breathing room, even on a tight budget.

Creating a Realistic Savings Goal

Creating a realistic savings goal is crucial when working with a tight budget. Avoid setting overly ambitious targets that lead to discouragement. Instead, start small and build momentum.

Begin by assessing your current financial situation. Track your income and expenses to understand where your money goes. Identify areas where you can reasonably cut back.

Set a SMART goal: Specific, Measurable, Achievable, Relevant, and Time-bound. For example, instead of “save more money,” aim for “save $50 per month for six months.” This provides a clear target and a timeline.

Consider your financial priorities. Are you saving for an emergency fund, a down payment, or a specific purchase? Prioritizing your savings goals helps you allocate funds effectively.

Regularly review and adjust your savings plan. Life changes, and your savings goals should adapt accordingly. If you fall short, don’t get discouraged; revise your plan and keep striving towards your financial goals.

Low-Cost Lifestyle Changes That Add Up

Small, consistent changes to your lifestyle can significantly impact your savings over time. Consider these low-cost adjustments:

Reduce energy consumption: Switch to energy-efficient light bulbs, unplug electronics when not in use, and lower your thermostat a few degrees in winter and raise it in summer. These seemingly minor actions accumulate into considerable savings on your utility bills.

Embrace mindful grocery shopping: Plan your meals ahead of time, create a grocery list, and stick to it. Avoid impulse buys and opt for budget-friendly alternatives. Cooking at home more often than eating out will also significantly cut costs.

Limit entertainment spending: Explore free or low-cost entertainment options such as visiting parks, libraries, or attending free community events. Minimize spending on subscriptions you don’t regularly use.

Cut down on transportation costs: Walk, bike, or use public transportation whenever possible. Carpooling with colleagues or friends can also reduce fuel costs and vehicle wear and tear.

Adopt a DIY approach: Instead of hiring professionals for minor repairs or home maintenance, learn to perform simple tasks yourself. This can save you a substantial amount of money in the long run.

By implementing these simple yet effective strategies, you can build a more frugal lifestyle without sacrificing your overall quality of life. The cumulative effect of these small changes will contribute significantly to your financial well-being.

Using Cashback and Coupon Tools

Cashback apps and coupon websites are powerful tools for stretching your budget. Cashback apps offer rewards for purchases made through their platform, effectively giving you a percentage of your spending back. Popular options include Rakuten and Fetch Rewards. Remember to check for activation requirements before making any purchases to ensure you receive your cashback.

Coupon websites and browser extensions provide access to a vast library of digital coupons. Sites like Coupons.com and RetailMeNot offer printable and digital coupons for various retailers. These coupons can be stacked with store sales and cashback offers for maximum savings. Always carefully read the terms and conditions of each coupon to avoid disappointment.

To maximize your savings, utilize a combination of both cashback and couponing strategies. For example, find a coupon for a product you need and then purchase it through a cashback app to double your savings. Remember to be strategic and only use coupons for items you would normally buy, avoiding impulse purchases just for the discount.

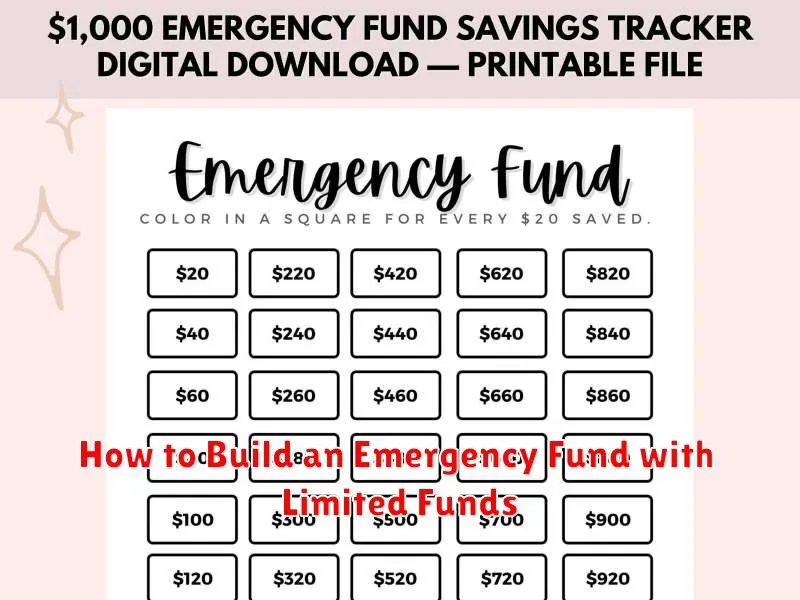

How to Build an Emergency Fund with Limited Funds

Building an emergency fund on a tight budget requires discipline and strategic saving. Start small; even saving a small amount consistently is better than nothing. Consider setting aside a small, manageable amount each week or month, focusing on what you can realistically afford.

Identify areas to cut back on non-essential spending. This might include reducing entertainment expenses, eating out less frequently, or finding cheaper alternatives for everyday items. Tracking your spending using a budget app or spreadsheet can help identify areas for improvement.

Automate your savings. Set up automatic transfers from your checking account to your savings account each payday. This makes saving consistent and effortless. Even a small automated transfer will add up over time.

Explore side hustles to supplement your income. Consider freelance work, gig jobs, or selling unused items. Every extra dollar earned can be channeled directly into your emergency fund.

Prioritize your emergency fund. Treat building your emergency fund as a high-priority bill. While tempting to use the money for other purposes, remember that this fund is for unforeseen circumstances, providing financial security and reducing stress.

Be patient and persistent. Building an emergency fund takes time and effort, especially on a limited budget. Celebrate small milestones to stay motivated, and remember that even a small emergency fund is better than none.

Automating Micro-Savings Effortlessly

Saving money on a tight budget requires strategic planning and consistent effort. One effective method is automating micro-savings. This involves setting up systems that automatically transfer small amounts of money from your checking account to a savings account on a regular basis.

Many banks and financial institutions offer tools to facilitate this. You can schedule recurring transfers, even setting it to a small amount like $1-$5 per day or $10-$20 per week. This approach minimizes the impact on your day-to-day spending while steadily building your savings.

Consider using round-up apps. These apps automatically round up your purchases to the nearest dollar and transfer the difference to your savings. While seemingly small, these accumulated amounts can surprisingly add up over time.

Another option is to set up automatic transfers after receiving your paycheck. Instantly allocate a pre-determined percentage or fixed amount to savings before you even have a chance to spend it.

By automating your micro-savings, you eliminate the need for constant manual effort and willpower. This passive savings approach contributes significantly to building a healthy financial cushion, even with a limited income.

Celebrating Milestones to Stay Motivated

Saving money on a tight budget can be challenging, often leading to feelings of frustration and demotivation. Celebrating milestones along the way is crucial for maintaining momentum and staying on track. This involves acknowledging and rewarding yourself for reaching specific savings goals, no matter how small.

For example, setting smaller, achievable goals like saving $50, $100, or even $25 can provide a sense of accomplishment. Upon reaching each milestone, reward yourself with something you enjoy, but that doesn’t compromise your savings plan. This could be a small treat, a night out with friends (within budget!), or even a relaxing activity at home.

Tracking your progress visually, perhaps using a chart or a savings app, helps make your achievements tangible and reinforces the positive reinforcement associated with reaching milestones. This visual representation of your success boosts morale and encourages continued effort. Remember, consistency is key, and celebrating your wins keeps you motivated to achieve your larger financial goals.