Planning for retirement can feel daunting, but securing your financial future is achievable with careful planning. This comprehensive guide on retirement planning will equip you with the knowledge and strategies needed to build a comfortable and secure retirement. We’ll explore essential topics like saving, investing, retirement accounts (including 401(k)s and IRAs), pension plans, Social Security benefits, and estate planning, providing actionable steps to help you achieve your financial goals and enjoy a fulfilling retirement.

Why You Should Start Retirement Planning Early

Starting retirement planning early offers significant advantages. The power of compound interest allows your investments to grow exponentially over time, resulting in a much larger nest egg compared to starting later. Even small contributions made early can accumulate substantially due to the compounding effect.

Early planning provides greater flexibility. You have more time to adjust your strategy based on market fluctuations or life changes. This allows for greater potential to recover from setbacks and adapt to unexpected events.

Beginning early reduces the financial burden later in life. Smaller contributions over a longer period are generally easier to manage than larger contributions needed to catch up when starting later. This eases stress and ensures you can maintain your desired lifestyle during retirement.

Ultimately, starting early increases your chances of achieving your retirement goals and enjoying a comfortable and secure retirement. Delaying only diminishes your chances and increases the necessary contribution amount later in life.

How Much Money Do You Need to Retire?

Determining the exact amount of money needed for retirement is highly individual and depends on several key factors. These include your desired lifestyle, current expenses, expected lifespan, and healthcare costs.

A common rule of thumb is the 80% rule, suggesting you’ll need 80% of your pre-retirement income to maintain your current lifestyle. However, this is a broad estimate. Inflation needs to be factored in, as the cost of goods and services will likely increase over time.

Retirement calculators can provide a more personalized estimate. These tools take into account your age, savings, expected investment returns, and other financial information to project your retirement needs. It’s crucial to use several different calculators to compare results.

Beyond the financial aspect, consider factors like health insurance coverage and potential long-term care expenses. These costs can significantly impact your retirement budget and should be thoroughly assessed.

Ultimately, planning for retirement requires a proactive and comprehensive approach. Start saving early, diversify your investments, and regularly review your financial plan to adjust for changing circumstances.

Best Retirement Savings Accounts and Tools

Planning for retirement requires a multifaceted approach, and selecting the right savings accounts and tools is crucial. 401(k)s, offered through employers, often include employer matching contributions, significantly boosting savings. Traditional IRAs provide tax-deductible contributions, while Roth IRAs offer tax-free withdrawals in retirement. The best choice depends on individual circumstances and tax brackets.

Beyond account selection, utilizing helpful retirement planning tools is essential. Retirement calculators help estimate future needs, while investment management platforms simplify portfolio diversification and tracking. Financial advisors can provide personalized guidance tailored to specific goals and risk tolerance. These resources enhance the effectiveness of retirement savings strategies.

Careful consideration of account fees and investment options within chosen accounts is vital. Lower fees maximize returns, while a diversified portfolio minimizes risk. Regularly reviewing and adjusting your retirement plan, especially as life circumstances change, is paramount to ensure you stay on track towards your financial goals.

The Role of Investments in Retirement Planning

Investing is crucial for securing a comfortable retirement. It allows your money to grow over time, supplementing your savings and providing a steady income stream during your retirement years.

Different investment vehicles, such as stocks, bonds, and mutual funds, offer varying levels of risk and return. A well-diversified portfolio, tailored to your risk tolerance and retirement goals, is essential. This diversification helps mitigate potential losses and maximize long-term growth.

Time horizon is a key factor. Younger investors typically have a longer time horizon and can afford to take on more risk, potentially investing a larger portion of their portfolio in equities. As retirement nears, a more conservative approach with less risk might be preferred.

Professional advice can be invaluable. A financial advisor can help you develop a personalized investment strategy, considering your individual circumstances, risk tolerance, and financial goals. They can also provide ongoing guidance and adjustments as needed.

Regular monitoring and adjustments are vital for maintaining a healthy investment portfolio. Market fluctuations are inevitable, and your investment strategy may require periodic review and adjustments to align with your evolving needs and market conditions.

Creating a Monthly Retirement Budget

Creating a realistic monthly retirement budget is crucial for securing your financial future. This involves carefully estimating your expenses and income during retirement.

Start by listing all your anticipated monthly expenses. This includes housing costs (rent or mortgage payments, property taxes, insurance), utilities, groceries, transportation, healthcare, entertainment, and any other regular spending. Be sure to factor in potential increases in costs, particularly healthcare, over time.

Next, estimate your retirement income. This will likely include Social Security benefits, pensions, and investment income. Be conservative in your projections, accounting for potential market fluctuations and longevity risk.

Compare your projected expenses to your estimated income. If your expenses exceed your income, you’ll need to adjust either your spending or your savings goals. This may involve downsizing your living arrangements, exploring more affordable healthcare options, or working part-time during retirement.

Regularly review and adjust your budget as circumstances change. Inflation, unexpected medical expenses, and changes in your lifestyle can all affect your financial needs in retirement.

Consider using budgeting tools or seeking advice from a financial advisor to help you create and manage your retirement budget effectively. Planning ahead and proactively managing your finances will significantly contribute to a comfortable and secure retirement.

Social Security: What You Need to Know

Social Security is a vital component of retirement planning for many Americans. It provides a monthly income stream designed to supplement other retirement savings.

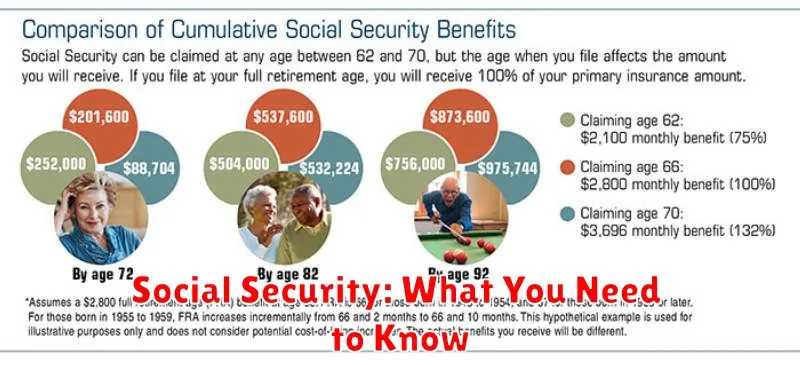

Eligibility for Social Security benefits is based on your work history and contributions through payroll taxes. The amount you receive depends on your earnings throughout your working life and the age at which you begin receiving benefits.

Full Retirement Age (FRA) is the age at which you’re entitled to receive your full Social Security benefits. This age varies depending on your birth year. Claiming benefits before your FRA will result in a permanently reduced monthly payment, while delaying benefits beyond your FRA will increase your monthly payment.

Claiming strategies exist, and the optimal strategy depends on individual circumstances and financial goals. Consulting with a financial advisor can help determine the best time to start receiving benefits to maximize your lifetime income.

Benefits beyond retirement: Social Security also provides disability insurance and survivor benefits, offering crucial financial protection for families in times of need.

Staying informed is key. The Social Security Administration (SSA) website offers comprehensive information, calculators, and resources to help you understand your benefits and plan effectively.

How to Adjust Plans Based on Age and Income

Retirement planning requires adaptability. Your plan should evolve as your age and income change. Younger individuals with lower incomes may focus on building a strong foundation through consistent contributions to retirement accounts and minimizing debt. They have more time to recover from market fluctuations and benefit from the power of compounding.

As you approach retirement age, your investment strategy needs adjustment. A more conservative approach might be necessary, reducing risk to protect accumulated savings. Income diversification becomes crucial, considering pensions, Social Security, and other potential revenue streams alongside retirement account withdrawals.

Income level significantly influences your retirement plan. Higher earners can generally contribute more to retirement accounts and potentially retire earlier. However, they may also have higher living expenses. Careful budgeting and strategic investing are key regardless of income, ensuring your savings align with your desired lifestyle in retirement. Individuals with lower incomes need to prioritize saving diligently and may need to work longer or adjust their retirement expectations.

Regularly reviewing and adjusting your plan is crucial, especially with significant life events or economic changes. Consider seeking professional financial advice to optimize your strategy based on your unique circumstances.

Common Retirement Planning Mistakes to Avoid

One of the most significant errors is underestimating expenses. Many individuals fail to accurately project their future cost of living, leading to insufficient savings.

Another common mistake is delaying saving. Starting early allows the power of compounding to maximize your returns. Procrastination significantly impacts long-term growth.

Ignoring inflation is another crucial oversight. Failing to account for inflation’s erosion of purchasing power renders retirement projections inaccurate and potentially insufficient.

Lack of diversification in investments exposes your retirement portfolio to unnecessary risk. A well-diversified portfolio spreads risk and potentially enhances returns.

Not having a written plan leaves retirement goals vague and increases the likelihood of falling short. A comprehensive plan, including savings goals and investment strategies, is crucial.

Finally, failing to regularly review and adjust your retirement plan is a significant mistake. Life circumstances change, necessitating plan adjustments to maintain alignment with goals.