Are you dreaming of financial freedom? Tired of the 9-to-5 grind? Learn how to build passive income streams and achieve lasting financial independence. This comprehensive guide will explore proven strategies for generating recurring revenue, allowing you to create a life of freedom and flexibility, ultimately building wealth and escaping the limitations of a traditional job. Discover diverse passive income ideas, from online businesses to real estate investments, and learn how to strategically create a portfolio of income sources that supports your financial goals.

What is Passive Income?

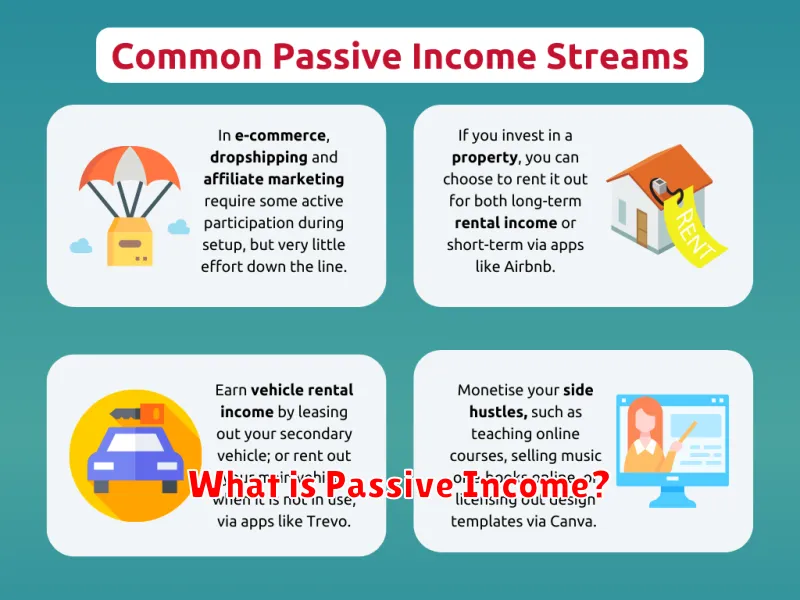

Passive income is income generated from an asset or business that requires minimal ongoing effort to maintain. It contrasts with active income, which necessitates consistent work to generate earnings. While some initial effort is typically involved in setting up a passive income stream, the ongoing maintenance demands significantly less time and energy than active income sources.

Examples include rental income from real estate, royalties from intellectual property (books, music), dividends from stocks, or earnings from affiliate marketing. It’s crucial to note that although termed “passive,” these streams often require some level of management and attention, albeit significantly less than a job or actively managed business.

The key difference lies in the scalability and automation potential. A well-structured passive income source can generate income even while the owner is engaged in other pursuits, representing a significant step towards financial freedom.

Types of Passive Income You Can Build

Building passive income streams requires careful planning and effort, but the rewards are well worth it. Several avenues exist for generating this type of income. Let’s explore some key options.

Affiliate marketing involves promoting other companies’ products or services and earning a commission on each sale made through your unique link. This can be achieved through blogs, social media, or email marketing.

Creating and selling digital products, such as ebooks, online courses, templates, or stock photos, offers a scalable way to generate passive income. Once created, these products can continue to generate revenue with minimal ongoing effort.

Investing in dividend-paying stocks or real estate provides a more traditional approach to passive income. While requiring an initial investment, these assets can generate consistent returns over time with minimal active management.

Licensing your intellectual property, including music, artwork, or software, allows others to use your creations in exchange for royalties. This can provide a consistent income stream with limited ongoing involvement.

Peer-to-peer lending involves lending money to individuals or businesses through online platforms and earning interest on the loan. While carrying some risk, it can offer potentially higher returns compared to traditional savings accounts.

Building and monetizing a website or blog can generate income through advertising, affiliate marketing, or selling products or services. This requires consistent content creation and marketing but can lead to significant long-term passive income.

The best type of passive income for you will depend on your skills, resources, and risk tolerance. It’s often beneficial to diversify your passive income streams to mitigate risk and maximize potential returns.

Investing in Stocks That Pay Dividends

Investing in dividend-paying stocks is a popular strategy for building passive income streams. Dividends are portions of a company’s profits distributed to shareholders. By owning shares in companies with a history of consistent dividend payouts, you can generate a regular income stream, supplementing your other income sources.

Selecting suitable stocks requires careful research. Look for companies with a long track record of dividend payments, strong financial performance, and sustainable business models. Consider factors such as dividend yield (the annual dividend payment relative to the stock price), payout ratio (the percentage of earnings paid out as dividends), and the company’s overall financial health.

Diversification is crucial. Don’t put all your eggs in one basket. Invest in a portfolio of different dividend-paying stocks across various sectors to reduce risk. This approach mitigates potential losses from any single company underperforming.

Reinvesting dividends can significantly accelerate wealth growth. By reinvesting your dividend payments back into more shares, you can benefit from the power of compounding, allowing your investment to grow exponentially over time. This strategy requires patience and a long-term perspective.

Remember that past performance doesn’t guarantee future results. While dividend history is important, always thoroughly research and assess the current financial health and future prospects of any company before investing.

Real Estate as a Passive Income Source

Real estate offers a potentially lucrative path to passive income. This involves generating income with minimal ongoing effort, once the initial investment and setup are complete.

Rental properties are a primary example. After purchasing a property and managing any necessary repairs or tenant issues, the rental income provides a consistent cash flow. The degree of passivity depends on your level of involvement in property management; hiring a property manager can significantly increase the passive nature of this income stream.

Beyond rental properties, other real estate ventures can contribute to passive income. Real Estate Investment Trusts (REITs) allow for indirect ownership in a portfolio of properties, generating dividends for investors. Real estate crowdfunding provides opportunities to invest smaller amounts in larger-scale projects, sharing in the potential profits.

However, it’s crucial to remember that while potentially passive, real estate investment requires significant upfront capital and carries inherent risks, including property market fluctuations and unexpected repair costs. Thorough due diligence and a realistic understanding of these risks are essential before embarking on any real estate investment strategy.

Creating and Selling Digital Products

Creating and selling digital products offers a powerful path to building passive income streams. These products, once created, can generate revenue with minimal ongoing effort. Examples include eBooks, online courses, templates, stock photos, and printables.

The initial investment involves product creation and marketing setup. Focus on identifying a niche market with a clear need for your product. Thorough market research is crucial to ensure demand and avoid wasted effort. High-quality content is essential for success.

Marketing your digital products effectively is key to driving sales. Utilize platforms like Etsy, Gumroad, or your own website. Employing strategies like social media marketing, email marketing, and paid advertising can significantly boost visibility and sales.

Pricing your products competitively while reflecting their value is important. Consider offering different pricing tiers or bundles to maximize revenue. Continuously monitor sales data and customer feedback to refine your offerings and marketing strategies.

Building a successful digital product business requires consistent effort and adaptation. While the income can be passive once established, the initial phase requires dedicated work. However, the potential for long-term financial freedom makes it a worthwhile endeavor.

Affiliate Marketing and Content Monetization

Affiliate marketing and content monetization are powerful strategies for building passive income streams. They work synergistically; you create valuable content (blog posts, videos, etc.) and embed affiliate links to products or services relevant to your audience. When a reader clicks your link and makes a purchase, you earn a commission—a passive income stream because you continue to earn even after the initial content creation.

Content monetization encompasses various methods beyond affiliate marketing, such as selling digital products (e-books, courses), offering subscriptions, or displaying ads. However, affiliate marketing is particularly attractive for its low startup cost and scalability. It allows you to leverage existing content to generate ongoing revenue.

To successfully implement these strategies, focus on creating high-quality, engaging content that genuinely helps your target audience. This builds trust and encourages clicks and conversions. Careful selection of affiliate products is also crucial; promote only items you believe in and that align with your audience’s needs. Consistent content creation is essential for long-term success, ensuring a steady flow of traffic and affiliate commissions.

While not entirely passive initially (requiring content creation and promotion), affiliate marketing and content monetization can lead to significant passive income over time with consistent effort and smart strategy. This allows for greater financial freedom by generating income streams independent of your active work hours.

Automating Your Earnings

Automating your earnings is crucial for building a sustainable passive income stream. This involves setting up systems and processes that generate income with minimal ongoing effort from you. Automation reduces your reliance on time and allows your money to work for you, even while you sleep.

Key strategies for automating your earnings include: leveraging digital products such as online courses or ebooks; using affiliate marketing to promote products and earn commissions; building and renting out real estate; or investing in dividend-paying stocks and bonds. Each of these requires initial setup and effort, but the ongoing maintenance is significantly reduced once automated.

Effective automation relies on efficient systems. For example, affiliate marketing success depends on optimizing website traffic and conversion rates. Real estate requires managing properties efficiently, potentially through property management companies. The key is to design your passive income streams to require minimal manual intervention.

Careful planning and selection of income streams are vital. Analyze your skills and resources to determine which automated income streams are best suited for you. Don’t underestimate the importance of consistent monitoring and optimization of your automated systems; although requiring less time than active income, regular checks are crucial for continued success.

Balancing Active and Passive Income for Growth

Achieving financial freedom often involves a strategic blend of active and passive income streams. Active income, earned through direct effort (e.g., salary, freelance work), provides immediate cash flow and fuels the initial development of passive income ventures. This initial investment is crucial.

Passive income, generated with minimal ongoing effort (e.g., rental properties, online courses), offers long-term growth and financial security. However, generating substantial passive income often requires significant upfront active work in planning, development, and marketing.

The ideal balance depends on individual circumstances and financial goals. Initially, a higher proportion of active income may be necessary to fund passive income projects. Over time, as passive income streams mature, the balance shifts, reducing reliance on active income and creating greater financial freedom. This transition allows for increased financial flexibility and personal time.

Careful planning and diversification are key. Don’t put all your eggs in one basket; develop multiple passive income streams to mitigate risk and ensure sustainable growth. Continuously re-evaluate your strategy based on performance and market trends to maximize your returns. This dynamic approach is critical for sustained success.