Creating a financial plan that truly works requires more than just budgeting; it demands a comprehensive strategy encompassing your short-term and long-term goals. This guide provides a step-by-step approach to building a personalized financial plan, covering crucial aspects like debt management, investment strategies, retirement planning, and emergency fund creation. Learn how to effectively manage your finances, achieve your financial objectives, and secure your future financial well-being.

Why You Need a Financial Plan

A financial plan provides a roadmap to your financial future, guiding you towards your financial goals. It’s not just about saving money; it’s about strategically managing your resources to achieve a secure and fulfilling life.

Without a plan, your finances risk being reactive rather than proactive. You might miss opportunities to maximize your savings, minimize debt, or prepare for unexpected expenses. A plan allows you to make informed decisions about your money, rather than letting chance dictate your financial well-being.

A well-structured plan provides clarity and control over your finances, reducing stress and increasing confidence in your ability to achieve your long-term objectives, whether it’s buying a home, retiring comfortably, or funding your children’s education.

Ultimately, a financial plan helps you secure your future and provides a framework for making sound financial decisions throughout your life. It’s an essential tool for building financial stability and achieving peace of mind.

Setting Short-Term and Long-Term Goals

Creating a successful financial plan hinges on setting clear short-term and long-term goals. Short-term goals are typically achievable within one year, focusing on immediate needs and wants. Examples include paying off a credit card debt, saving for a vacation, or building an emergency fund.

Long-term goals, on the other hand, are those you aim to achieve over a longer period, such as five, ten, or even more years. These often involve larger financial objectives like buying a house, funding your children’s education, or securing a comfortable retirement. These goals require consistent saving and investment strategies.

The key is to make these goals SMART: Specific (clearly defined), Measurable (trackable progress), Attainable (realistic), Relevant (aligned with your values), and Time-bound (with deadlines).

By establishing a blend of short-term and long-term financial objectives, you create a roadmap for your financial future, fostering motivation and providing a framework for making informed financial decisions. Regularly reviewing and adjusting your goals ensures they remain aligned with your evolving circumstances and aspirations.

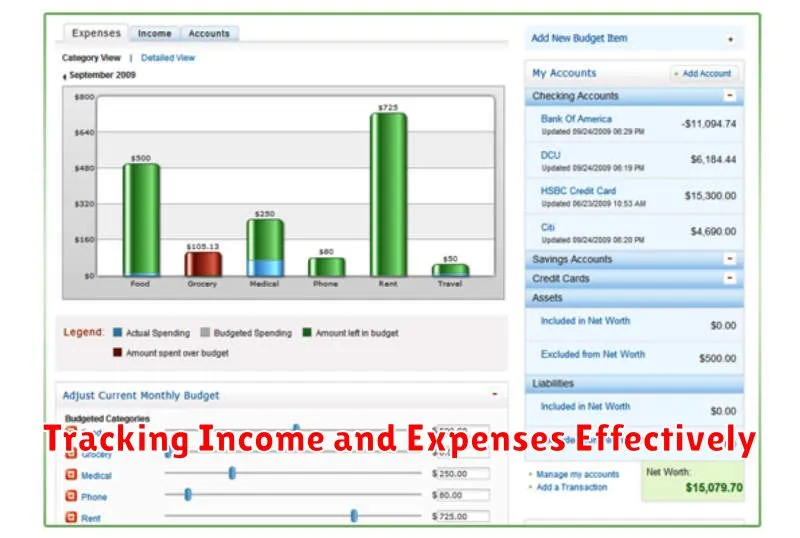

Tracking Income and Expenses Effectively

Effectively tracking your income and expenses is fundamental to a successful financial plan. This provides a clear picture of your current financial situation, allowing you to identify areas for improvement.

Several methods exist for tracking your finances. Budgeting apps offer automated tracking and analysis. Alternatively, a simple spreadsheet can be used to manually record income and expenses. Choosing the method best suited to your needs and tech proficiency is crucial.

Consistency is key. Make it a habit to record all transactions daily or at least weekly. The more accurate your data, the more effective your financial planning will be. Categorizing your expenses (e.g., housing, transportation, food) will further enhance your understanding of spending habits.

Regularly reviewing your tracked data will reveal spending patterns and areas where you can save money. This information is essential for creating realistic budgeting goals and making informed financial decisions.

By diligently tracking your income and expenses, you gain valuable insights into your financial health, paving the way for a more effective and successful financial plan.

Building an Emergency Fund

A robust emergency fund is the cornerstone of any successful financial plan. It provides a crucial safety net for unexpected expenses, preventing you from going into debt or disrupting your long-term financial goals.

Aim to save 3-6 months’ worth of living expenses. This amount should cover essential costs like rent, utilities, groceries, and transportation. The higher the number, the greater the protection against unforeseen circumstances.

Start small and be consistent. Even saving a small amount regularly is better than nothing. Automate your savings by setting up recurring transfers from your checking account to a dedicated savings account. Consider using high-yield savings accounts to maximize your returns.

Track your progress. Regularly monitor your savings to stay motivated and ensure you’re on track to reach your goal. Adjust your savings plan as needed based on your income and expenses.

Protect your emergency fund. Avoid dipping into it for non-emergency expenses. This fund is specifically designed for unexpected events, ensuring financial stability during challenging times.

Planning for Major Life Events

Major life events, such as marriage, buying a home, having children, or retirement, significantly impact your finances. Proper planning is crucial to navigate these transitions smoothly.

Marriage often involves merging finances, requiring discussions about shared expenses, debt, and long-term savings goals. A joint financial plan is essential.

Homeownership is a substantial investment. Thorough planning includes saving for a down payment, understanding mortgage options, and budgeting for ongoing home maintenance and property taxes. Factor in potential closing costs.

Raising children brings significant expenses, including childcare, education, and healthcare. Establishing a college savings plan early is highly recommended. Budgeting for increased household costs is critical.

Retirement planning requires long-term vision. Start saving early and consistently, taking advantage of employer-sponsored retirement plans and considering various investment strategies to ensure a comfortable retirement. Determine your desired retirement lifestyle and plan accordingly.

By proactively addressing these major life events in your financial plan, you can minimize stress and ensure financial stability throughout your life.

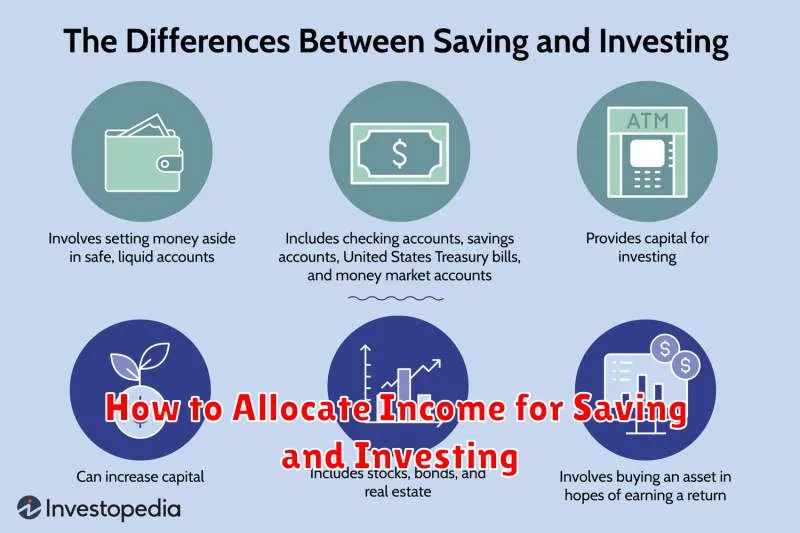

How to Allocate Income for Saving and Investing

Creating a robust financial plan requires a strategic approach to income allocation. A key component is determining how much to dedicate to saving and investing. This allocation should align with your financial goals and risk tolerance.

Start by defining your short-term and long-term objectives. Short-term goals might include an emergency fund or a down payment on a car, while long-term goals could encompass retirement, a down payment on a house, or your children’s education. The timeframe for each goal will influence your saving and investing strategy.

The 50/30/20 rule offers a simple framework: allocate 50% of your after-tax income to needs (housing, food, utilities), 30% to wants (entertainment, dining out), and 20% to savings and investments. Adjust these percentages based on your individual circumstances and goals. For example, if you prioritize early retirement, you might increase the 20% allocation.

Within the 20% allocated to saving and investing, consider diversifying your investments across different asset classes, such as stocks, bonds, and real estate. The specific asset allocation will depend on your risk tolerance and time horizon. A financial advisor can help you determine the appropriate mix.

Regularly review and adjust your savings and investment strategy as your financial situation and goals evolve. Life changes, such as a new job or family, may require you to re-evaluate your allocation.

Monitoring and Adjusting Your Plan Regularly

Creating a financial plan is only the first step; regular monitoring and adjustment are crucial for its success. Life throws curveballs – job changes, unexpected expenses, market fluctuations – all impacting your financial landscape.

Track your progress against your goals. Compare your actual spending to your budget, and analyze your investment performance. Use budgeting apps, spreadsheets, or financial software to simplify this process.

Regular reviews, ideally quarterly or annually, are vital. These reviews allow you to identify discrepancies between your plan and reality. Are you on track to meet your savings goals? Are your investments performing as expected? Are there areas where you need to cut back or adjust your strategy?

Adjustments may involve altering your spending habits, re-evaluating your investment portfolio, or modifying your savings targets. Be flexible and adaptable; your plan should evolve with your circumstances.

Professional advice can be invaluable. A financial advisor can provide objective guidance and help you navigate unexpected challenges or significant life changes that require plan modifications. Don’t hesitate to seek professional assistance when needed.

When to Consult a Financial Advisor

Seeking professional financial guidance is a crucial step in creating a successful financial plan. While many individuals can manage their finances independently, consulting a financial advisor becomes particularly beneficial during specific life stages and circumstances. Significant life changes such as marriage, childbirth, job loss, inheritance, or retirement necessitate expert advice to navigate the resulting financial complexities.

Complex financial situations also warrant professional help. This includes managing significant debt, investing in complex instruments like options or futures, or planning for large purchases like a house or business. A financial advisor possesses the expertise to analyze your unique situation and develop a tailored strategy that aligns with your goals.

Furthermore, if you lack the time, knowledge, or confidence to effectively manage your finances, seeking professional assistance is strongly recommended. A financial advisor can provide valuable insights, create a comprehensive plan, and offer ongoing support, ensuring you stay on track towards your financial objectives. Ultimately, the decision to consult an advisor is a personal one, but considering these factors can guide you towards making the right choice for your unique circumstances.