Are you struggling with overwhelming debt? Feeling the pressure of high interest rates and minimum payments? Discover smart strategies to conquer your debt and achieve financial freedom faster than you ever thought possible. This article unveils effective methods for debt payoff, including practical tips on budgeting, debt consolidation, and negotiating with creditors. Learn how to create a personalized debt repayment plan that aligns with your financial goals and empowers you to take control of your financial future. Let’s explore smart ways to pay off debt faster and reclaim your peace of mind.

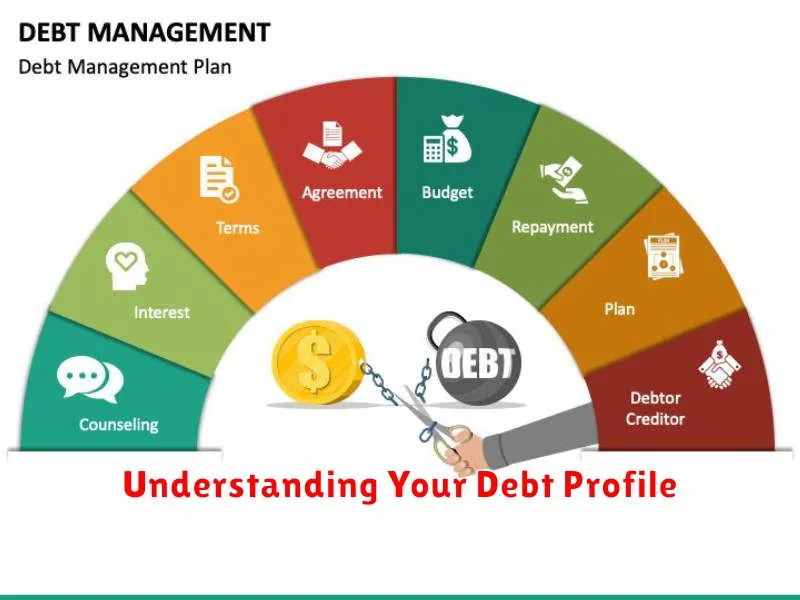

Understanding Your Debt Profile

Before you can strategize effectively for faster debt repayment, you must first understand your debt profile. This involves identifying all your debts – including credit cards, loans, and other outstanding balances.

For each debt, note the principal balance, the interest rate, and the minimum payment. Higher interest rates mean you’re paying more in interest over time, making them a priority for repayment.

Categorize your debts. Are they secured (backed by collateral, like a mortgage or auto loan) or unsecured (like credit cards)? This distinction impacts the implications of default and potential collection actions.

Calculating your debt-to-income ratio (DTI) is crucial. This ratio compares your total monthly debt payments to your gross monthly income. A high DTI indicates a higher level of financial strain. Understanding your DTI helps gauge your ability to handle additional debt and inform your repayment strategy.

Finally, consider the terms and conditions of each debt. Are there prepayment penalties? Knowing this will help you determine the most effective repayment strategy, such as the debt avalanche or debt snowball methods.

Creating a Debt Repayment Plan

A well-structured debt repayment plan is crucial for effectively tackling your debt. The first step is to gather all your debt information, including balances, interest rates, and minimum payments. This provides a clear overview of your financial situation.

Next, choose a debt repayment method. Popular strategies include the debt snowball (paying off the smallest debt first for motivation) and the debt avalanche (paying off the debt with the highest interest rate first to save money). Consider your personality and financial goals when selecting a method.

Once you’ve chosen your method, create a detailed budget. This involves tracking your income and expenses to identify areas where you can cut back and allocate more funds towards debt repayment. Prioritize essential expenses and eliminate unnecessary spending.

Regularly monitor your progress and make adjustments to your plan as needed. Life circumstances change, and your plan should adapt accordingly. Celebrating milestones along the way can help maintain motivation and prevent discouragement.

Finally, seek professional help if you’re struggling to manage your debt. Credit counseling agencies can provide guidance and support in developing a manageable repayment plan and potentially negotiating with creditors.

Snowball vs Avalanche Method

When tackling multiple debts, two popular strategies stand out: the snowball and avalanche methods. Both aim for faster debt repayment, but differ in their approach.

The snowball method prioritizes psychological momentum. You focus on paying off the smallest debt first, regardless of interest rate. Once that’s cleared, you roll the payment amount into the next smallest debt, creating a “snowball” effect. This approach boosts motivation by providing early wins and a sense of accomplishment.

Conversely, the avalanche method prioritizes financial efficiency. You tackle debts with the highest interest rate first, minimizing the total interest paid over time. While less motivating initially, this method saves you money in the long run and ultimately leads to faster debt elimination.

The best method depends on individual circumstances and priorities. If you value the psychological boost of early wins and need that motivation, the snowball method is preferable. If minimizing total interest paid is your top priority, the avalanche method is the more financially sound choice.

How to Negotiate Lower Interest Rates

Negotiating a lower interest rate on your debt can significantly reduce the total amount you pay and accelerate your debt payoff journey. Preparation is key. Before contacting your lender, gather all relevant information, including your credit score, outstanding balance, and payment history.

Next, research your options. See what interest rates other lenders are offering for similar products. This information gives you leverage during your negotiation.

When you contact your lender, be polite and professional. Clearly explain your situation and your desire to lower your interest rate. Highlight your positive payment history, if applicable, to demonstrate your reliability. Propose a specific lower rate based on your research, and be prepared to negotiate.

Consider offering a longer repayment term in exchange for a lower rate, but carefully weigh the potential increase in total interest paid against the benefit of a lower monthly payment. Be prepared to walk away if your lender is unwilling to negotiate to a reasonable rate.

Finally, document everything. Keep records of all communications, including emails and phone calls, along with any agreements you reach. This documentation is crucial for protecting your rights and ensuring the lender adheres to the negotiated terms.

Consolidation Options for Managing Debt

Debt consolidation simplifies debt management by combining multiple debts into a single payment. This can streamline the repayment process, potentially lowering your monthly payment and simplifying budgeting. Several options exist, each with its own advantages and disadvantages.

Balance transfer credit cards offer a temporary 0% APR period, allowing you to pay down debt interest-free. However, be aware of balance transfer fees and the interest rate that applies after the introductory period expires. Carefully consider the APR and any associated fees.

Personal loans consolidate debts into a fixed-rate loan with a set repayment schedule. This provides predictability, but interest rates vary depending on your credit score. A lower interest rate than your current debts can significantly reduce overall interest paid.

Debt management plans (DMPs) are offered through credit counseling agencies. They negotiate lower interest rates and monthly payments with your creditors. However, this option may negatively impact your credit score.

Home equity loans or lines of credit (HELOCs) use your home’s equity as collateral. While potentially offering lower interest rates, defaulting on such a loan can lead to foreclosure. This option carries significant risk and should be carefully considered.

Choosing the right consolidation option depends on your individual financial situation, credit score, and risk tolerance. Careful planning and comparison shopping are essential to ensure you select the most beneficial approach.

Avoiding New Debt During Repayment

Successfully paying off debt requires a focused strategy and strong self-discipline. A crucial element is avoiding the accumulation of new debt during the repayment process. This can significantly hinder progress and prolong the time it takes to become debt-free.

To prevent new debt, create a realistic budget that accounts for all income and expenses. Identify areas where spending can be reduced. This might involve cutting back on non-essential purchases, finding more affordable alternatives, or utilizing budgeting apps to track spending habits.

Before making any purchases, especially larger ones, ask yourself if it’s a necessity or a want. Postponing non-essential purchases will free up funds for debt repayment. If a purchase is necessary, explore options like saving up or using existing funds rather than incurring new debt.

Consider using cash instead of credit cards to manage spending. The physical act of handing over cash can help curb impulsive purchases. Furthermore, avoid using credit cards for everyday expenses unless you can pay off the balance in full each month.

Building an emergency fund is another key strategy. Having savings to cover unexpected expenses prevents the need to take on new debt when faced with unforeseen circumstances. Aim to accumulate 3-6 months’ worth of living expenses in a readily accessible savings account.

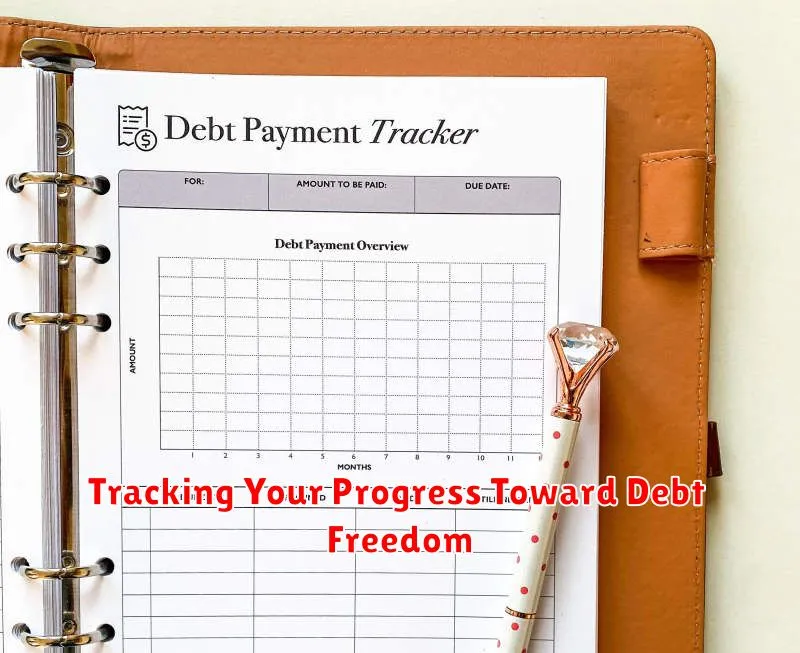

Tracking Your Progress Toward Debt Freedom

Tracking your progress is crucial for staying motivated and on track while paying off debt. A clear understanding of your journey fosters a sense of accomplishment and helps you adjust your strategy as needed.

Effective methods include using budgeting apps, spreadsheets, or debt repayment trackers. These tools allow you to visualize your debt, monitor payments, and see the impact of your efforts. Consider creating a visual representation of your debt, such as a chart or graph, to further illustrate your progress.

Regularly review your progress. Weekly or monthly check-ins allow you to celebrate milestones, identify areas needing improvement, and maintain momentum. This consistent monitoring ensures you stay focused and prevents you from losing sight of your goal.

Celebrating your achievements, no matter how small, reinforces positive behavior and keeps you motivated. Acknowledging your hard work and dedication is essential for long-term success in your debt repayment journey.

Building Better Habits After Paying Off Debt

Paying off debt is a significant achievement, requiring discipline and sacrifice. To maintain financial stability and avoid future debt, it’s crucial to cultivate positive financial habits.

One key habit is budgeting. Create a realistic budget that tracks income and expenses, allowing you to allocate funds for savings, investments, and occasional spending. Tracking your spending using budgeting apps or spreadsheets provides valuable insights into your spending patterns, aiding in better financial decision-making.

Building an emergency fund is equally important. Aim for 3-6 months’ worth of living expenses to cover unexpected events without resorting to debt. This financial safety net offers peace of mind and prevents future debt accumulation.

Finally, consistently reviewing your financial progress is crucial. Regularly check your budget, savings, and investments to ensure you’re on track and make necessary adjustments. This proactive approach helps solidify good financial habits and ensures long-term financial health.