Building wealth on an average income is entirely achievable with the right strategies. This article will guide you through practical steps to grow your net worth, from mastering budgeting and saving to leveraging investing and debt management. Learn how to create a wealth-building plan tailored to your financial situation and start your journey toward financial freedom today. Discover the secrets to achieving financial independence without needing a high salary.

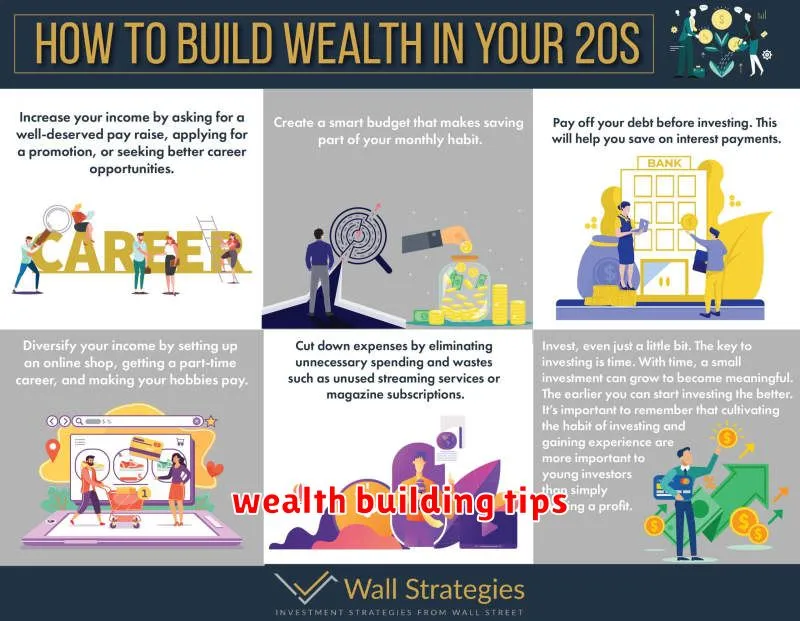

Why Income Isn’t the Only Factor in Wealth

While a high income undoubtedly accelerates wealth building, it’s not the sole determinant. Wealth is a function of how much you earn, but more importantly, how much you save and how effectively you invest those savings.

Individuals with average incomes can accumulate significant wealth through diligent saving and strategic investing. This involves making conscious decisions about spending, prioritizing debt reduction, and selecting investment vehicles that align with their financial goals and risk tolerance.

Spending habits play a crucial role. Even with a modest income, minimizing unnecessary expenses and practicing mindful consumption frees up funds for saving and investment. Similarly, effective debt management, such as paying down high-interest debt, is vital, as it reduces the financial burden and increases the amount available for wealth-building activities.

Finally, financial literacy is paramount. Understanding basic investment principles, such as diversification and compounding, allows individuals to make informed decisions that maximize their returns over time. Consistent investment, even with small amounts, can yield substantial growth through the power of compounding.

Saving First, Then Spending

Building wealth on an average income requires a fundamental shift in mindset: saving first, then spending. This contrasts with the common approach of spending first and saving what’s left, which often leaves little to nothing for saving.

The “pay yourself first” method involves automatically transferring a predetermined percentage of your income – ideally 15-20% or more – into a savings or investment account before you allocate funds for living expenses. This ensures that saving is prioritized and becomes a non-negotiable part of your budget.

By prioritizing saving, you’re actively building your financial future. This disciplined approach allows you to accumulate capital for investments, emergency funds, and long-term goals like buying a house or retirement planning, all while living within your means. Effective budgeting and mindful spending are crucial components to this strategy, but the core principle remains: save first, then spend.

While it may require initial sacrifices, the long-term benefits of saving first are significant. It instills financial discipline, fosters a sense of control over your finances, and ultimately contributes to building substantial wealth over time, even on an average income.

How to Live Below Your Means

Living below your means is a cornerstone of building wealth, regardless of income level. It’s about consciously spending less than you earn, creating a surplus that can be directed towards saving and investing. This isn’t about deprivation; it’s about mindful spending.

Track your spending: Use budgeting apps or spreadsheets to monitor where your money goes. Identifying areas of overspending is crucial for making informed adjustments.

Create a realistic budget: Allocate funds for necessities, essential expenses, and savings. Prioritize needs over wants, and consciously limit discretionary spending.

Reduce unnecessary expenses: Identify areas where you can cut back without significantly impacting your lifestyle. This might involve canceling subscriptions, cooking at home more often, or finding cheaper alternatives for entertainment.

Embrace a frugal mindset: This isn’t about being cheap, but about making conscious choices that align with your financial goals. Look for value, not just the lowest price, and consider the long-term implications of your spending decisions.

Automate savings: Set up automatic transfers from your checking account to your savings and investment accounts. This ensures consistent saving, even when you’re busy or tempted to spend.

By consistently living below your means, you’ll generate a financial cushion, build emergency funds, and accumulate assets that contribute significantly to long-term wealth building. It’s a powerful strategy accessible to everyone.

Starting Small with Investments

Building wealth on an average income requires a strategic approach, and investing is a crucial component. The good news is you don’t need a large sum to begin. Start small with what you can comfortably afford. Even $50 or $100 a month can make a significant difference over time due to the power of compounding.

Consider utilizing low-cost index funds or ETFs to diversify your investments and minimize risk. These provide broad market exposure without requiring extensive research. Dollar-cost averaging, a strategy of investing a fixed amount regularly regardless of market fluctuations, can also be beneficial in mitigating risk and smoothing out volatility.

Automate your investments whenever possible. Setting up automatic transfers from your checking account to your brokerage account ensures consistent contributions and eliminates the need for manual effort. This consistent approach fosters discipline and facilitates long-term growth.

Finally, remember that consistency is key. While market fluctuations are inevitable, maintaining your investment schedule through both ups and downs will significantly contribute to your long-term financial success.

Using Side Hustles to Grow Assets

Building wealth on an average income requires strategic financial planning and resourcefulness. One powerful tool is leveraging side hustles to generate additional income streams and accelerate asset growth.

Diversify your income: Side hustles offer a chance to escape the limitations of a single income source. This diversification reduces financial risk and increases your overall earning potential.

Invest your earnings wisely: The key to building assets isn’t just earning more, but strategically allocating those earnings. Prioritize investing your side hustle income in growth assets such as stocks, real estate, or business ventures.

Choose a sustainable hustle: Selecting a side hustle aligned with your skills and interests is crucial for long-term success. Avoid unsustainable ventures that burn you out or demand excessive time commitment.

Reinforce your financial literacy: Understanding basic financial principles, such as budgeting, investing, and debt management, is essential to maximize the impact of your side hustle income and effectively grow your assets.

By strategically employing side hustles and making informed financial decisions, individuals with average incomes can build significant wealth over time. The key lies in consistent effort, smart investment choices, and a disciplined approach to managing finances.

Making Smart Purchases and Avoiding Debt

Building wealth on an average income requires a strategic approach to spending. Avoiding unnecessary debt is paramount. This means carefully considering purchases and prioritizing needs over wants.

Smart purchasing involves comparing prices, researching products, and seeking discounts or sales. Resisting impulse buys and focusing on long-term value is crucial. Before making any significant purchase, create a budget and ensure it aligns with your financial goals.

Managing existing debt is equally important. Prioritize paying down high-interest debt first, such as credit card balances. Explore debt consolidation options to simplify repayments and potentially lower interest rates. Building a strong credit score also makes future borrowing more affordable.

By making conscious spending choices and actively managing debt, you can significantly improve your financial health and accelerate your wealth-building journey, even with a modest income.

The Power of Compound Interest Over Time

Building wealth on an average income requires a long-term strategy, and compound interest is a crucial component. This powerful concept involves earning interest not only on your initial investment (principal), but also on the accumulated interest itself.

Imagine investing a small amount regularly. Over time, the interest earned adds to your principal, and subsequently, the interest earned on this larger amount grows exponentially. This snowball effect is the magic of compounding. The longer your money is invested, the more significant the impact of compounding becomes.

While the initial returns might seem modest, the cumulative effect over decades can be transformative. Consistency is key; regular contributions, however small, significantly enhance the power of compounding.

Time horizon is another critical factor. The longer you allow your investments to grow, the greater the potential for substantial wealth accumulation through the magic of compound interest. Even small, consistent investments made early in life can yield remarkable results by retirement.

Understanding and leveraging the power of compound interest is fundamental to building wealth steadily, even with an average income. It’s a cornerstone of long-term financial success.

Tracking Net Worth and Progress Regularly

Regularly tracking your net worth is crucial for building wealth on an average income. This involves calculating the difference between your assets (what you own) and your liabilities (what you owe).

Use a spreadsheet or personal finance software to simplify this process. Include all your assets, such as savings accounts, investments, and property, and all your liabilities, like loans and credit card debt. Calculate your net worth monthly or quarterly.

Beyond just the number, analyzing the trends in your net worth is equally important. Are you consistently increasing your net worth? Are there areas where you can improve? This data helps you stay motivated, identify areas for improvement in your budget and investment strategy, and celebrate your achievements along the way.

Monitoring your progress provides valuable insights and keeps you accountable. It enables data-driven decision-making, leading to more effective wealth-building strategies.