Effectively managing your finances can feel overwhelming, but utilizing financial apps can simplify the process significantly. This article will guide you on how to leverage the power of budgeting apps, investment apps, and other money management tools to achieve your financial goals efficiently. Learn how to track spending, create a realistic budget, and make informed investment decisions, all from the convenience of your smartphone or computer. Discover the best personal finance apps to streamline your money management and take control of your financial future.

Why Financial Apps Can Help You Stay Organized

Financial apps offer a centralized location for all your financial information, eliminating the need to sift through numerous bank statements, receipts, and spreadsheets. This consolidation significantly improves organization.

Automatic tracking of transactions is a key benefit. Many apps automatically categorize and record your spending, providing a clear picture of your income and expenses without manual data entry. This automated process minimizes the risk of overlooking crucial financial details.

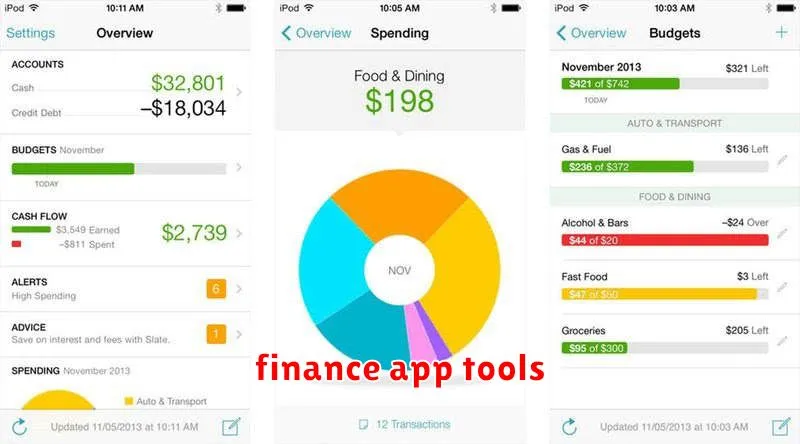

Budgeting tools within these apps allow you to set financial goals and monitor your progress. They provide visual representations of your spending habits, enabling you to easily identify areas where you can save or adjust your budget. This visual clarity greatly enhances your understanding of your financial situation.

Furthermore, features like bill reminders and payment scheduling help prevent late fees and improve your overall financial health. These features streamline your payment processes and ensure you stay on top of your financial obligations.

In essence, financial apps transform the often tedious and disorganized process of managing personal finances into a streamlined and easily manageable system, promoting better financial habits and reducing stress.

Top Budgeting Apps for Daily Spending

Managing daily spending effectively requires a robust budgeting app. Several excellent options cater to different needs and preferences. Mint provides a comprehensive overview of your finances, including budgeting tools and spending tracking. It’s particularly useful for those wanting a holistic view of their financial situation.

YNAB (You Need A Budget) employs a zero-based budgeting approach, encouraging users to allocate every dollar to a specific purpose. This method helps users gain a clearer understanding of their spending habits and promotes mindful financial decisions. It’s ideal for users seeking more control over their finances.

Personal Capital is a strong choice for those who also require investment tracking alongside budgeting. Its dashboard provides a clear picture of net worth and investment performance. It’s best suited for users with a more complex financial portfolio.

PocketGuard focuses on showing users how much they have left to spend after essential bills are factored in. This “leftover” money is then available for discretionary spending, providing a straightforward view of daily spending capacity. It’s suitable for users who prioritize a simplified budgeting experience.

EveryDollar, from Dave Ramsey, is a simple, straightforward budgeting app that aligns with the debt-elimination methods of Dave Ramsey. It’s user-friendly and a great option for those new to budgeting.

The best budgeting app for you will depend on your specific needs and financial goals. Consider factors like ease of use, features offered, and overall integration with your existing financial systems when making your selection. Many offer free versions with the option to upgrade to premium for enhanced functionality.

Apps for Saving and Investing Automatically

Several apps offer automated savings and investing features, simplifying the process of building wealth. These tools often integrate with your bank account and allow you to set recurring transfers to savings or investment accounts. This automated approach helps build good financial habits by consistently allocating funds without requiring manual intervention.

Acorns, for example, rounds up your purchases to the nearest dollar and invests the difference. Stash offers a similar fractional investing approach, making it accessible for individuals with smaller investment amounts. Betterment and Wealthfront are robo-advisors providing automated portfolio management based on your risk tolerance and financial goals.

Choosing the right app depends on your individual needs and preferences. Consider factors such as investment minimums, fee structures, and the level of customization offered. Carefully review the terms and conditions before connecting your bank account to any financial app.

Benefits of using these apps include convenience, consistency, and the potential to grow your wealth over time through regular, automated contributions. The removal of manual effort can improve financial discipline and reduce the risk of procrastination.

Tracking Net Worth and Financial Goals

Financial apps offer powerful tools for tracking your net worth. By inputting your assets (like cash, investments, and property) and liabilities (like loans and credit card debt), these apps automatically calculate your net worth, providing a clear picture of your financial health. Regular monitoring allows you to identify trends and make informed decisions.

Many apps also facilitate goal setting. You can define specific financial targets, such as saving for a down payment, retirement, or a vacation. The apps then help you track your progress towards these goals, often providing visualizations and projections based on your current savings rate and investment performance. This feature promotes accountability and helps you stay motivated.

Furthermore, some apps offer budgeting tools integrated with net worth tracking. By linking your bank accounts and credit cards, you gain insights into your spending habits, enabling you to adjust your budget to align with your financial goals. This holistic approach ensures that your spending patterns support your overall net worth and goal attainment.

Debt Reduction Tools You Can Use

Many financial apps offer debt reduction tools to help you manage and pay down your debt efficiently. These tools often include features like debt trackers, which allow you to monitor your progress and visualize your debt payoff journey. Some apps provide budgeting tools integrated with debt tracking, helping you allocate funds effectively towards debt repayment.

Several apps offer debt snowball or avalanche calculators. These tools help you strategize your repayment plan by prioritizing either the smallest debt (snowball) or the debt with the highest interest rate (avalanche). This allows you to make informed decisions about which debts to tackle first for optimal efficiency.

Some advanced apps even provide personalized debt reduction plans based on your income, expenses, and debt amounts. These plans may suggest specific payment amounts and timelines to help you achieve your debt-free goals sooner. Remember to carefully review any plan suggestions and adjust as needed to fit your individual financial circumstances.

Beyond the core features, look for apps that offer automatic payment reminders and secure data storage to simplify the process and protect your sensitive financial information. The best app for you will depend on your specific debt situation and personal preferences.

Setting Alerts and Automations for Bills

Many financial apps offer features to significantly simplify bill management. Setting up alerts for upcoming due dates is a crucial first step. This ensures you’re always aware of when payments are needed, preventing late fees and impacting your credit score. Most apps allow you to customize these alerts, choosing the method of notification (email, push notification, SMS) and the timeframe before the due date.

Beyond alerts, explore the automation options. Some apps allow you to schedule recurring payments directly, eliminating the need for manual input each month. This feature is particularly helpful for consistent bills like rent, utilities, and subscriptions. Ensure the app securely stores your payment information and that you regularly review the automated payments to prevent errors.

Bill categorization within the app can also enhance your financial overview. Many apps automatically categorize transactions; however, manual adjustment might be necessary. This organized view helps you track spending on various bills, identify potential areas for savings, and better manage your overall budget.

Utilizing these alert and automation features provides a proactive approach to bill management, reducing stress and improving your financial health. Remember to choose an app that fits your specific needs and financial habits.

Evaluating Security and Data Protection

Before using any financial app, thoroughly research its security measures. Look for apps with strong encryption, two-factor authentication (2FA), and a proven track record of protecting user data. Read user reviews and check for any reported security breaches.

Understand the app’s privacy policy. This document outlines how your data is collected, used, and protected. Pay close attention to details regarding data sharing with third parties and data retention policies. Only use apps with transparent and trustworthy privacy practices.

Beware of phishing scams. Financial apps are prime targets for malicious actors. Never click on links or download attachments from suspicious emails or text messages claiming to be from your financial app provider. Always access your app through the official app store or website.

Regularly review your app’s security settings. Ensure 2FA is enabled and that your password is strong and unique. Consider enabling biometric authentication if offered. Stay informed about potential security threats and update the app regularly to benefit from the latest security patches.

Protecting your financial information is paramount. By carefully evaluating the security and data protection measures of a financial app, you can significantly reduce your risk of fraud and identity theft and use these apps confidently.

Choosing the Right App for Your Needs

Selecting the right financial app depends heavily on your specific needs and financial goals. Consider what aspects of your finances you want to improve. Are you looking to budget, track spending, invest, or manage debt? Different apps specialize in different areas.

Budgeting apps often provide features like expense categorization, goal setting, and spending visualizations. Investing apps allow you to buy and sell stocks, bonds, and other assets, often with educational resources. Debt management apps help you track and pay down debts more efficiently. Some apps offer a combination of these features, while others focus on a single area.

Before committing, read reviews and compare features. Pay close attention to user experience, security measures, and any associated fees. Consider whether the app integrates with your existing bank accounts and financial institutions seamlessly. Choosing an app that aligns with your financial literacy level and comfort with technology is crucial for long-term success.

Ultimately, the “best” app is the one that you find easy to use and motivates you to actively manage your finances. Don’t hesitate to try out a few different apps before settling on one that perfectly fits your needs.