Setting achievable financial goals can feel overwhelming, but it doesn’t have to be. This article provides a practical guide on how to define SMART financial goals – Specific, Measurable, Achievable, Relevant, and Time-Bound – that will help you build a strong financial foundation. Learn effective strategies to budget effectively, manage debt, and save for the future, transforming your financial aspirations into tangible realities. Discover how to create a personalized financial plan tailored to your unique circumstances and achieve your financial dreams.

Why Financial Goals Matter

Setting financial goals is crucial for several reasons. First, they provide direction and purpose to your financial life, preventing you from drifting aimlessly and making impulsive decisions. Without defined goals, it’s difficult to measure progress and stay motivated.

Secondly, clearly defined goals allow for effective planning. Whether you’re saving for a down payment, retirement, or paying off debt, having specific targets helps you create a realistic budget and a strategic plan to achieve them. This process includes determining how much you need to save, invest, or pay off, and setting a timeline.

Finally, achieving financial goals fosters a sense of accomplishment and confidence. Each milestone reached boosts your motivation and reinforces the importance of disciplined financial management. This positive reinforcement can lead to a cycle of success, making it easier to set and achieve even more ambitious goals in the future.

Types of Financial Goals: Short, Medium, Long-Term

Defining your financial goals by time horizon is crucial for effective planning. Categorizing them into short, medium, and long-term allows for focused action and realistic expectations.

Short-term goals typically span less than a year. These might include paying off a small debt like a credit card balance, saving for a vacation, or building an emergency fund. Actionable steps involve budgeting diligently and identifying quick wins to achieve these goals swiftly.

Medium-term goals usually extend from one to five years. Examples include saving for a down payment on a car, accumulating funds for a larger home renovation, or paying off student loans. Strategic planning becomes more important here, involving consistent saving and potentially higher-yield investment strategies.

Long-term goals extend beyond five years. These often involve major life milestones such as retirement planning, buying a home, or funding a child’s education. Long-term strategies are essential, requiring disciplined saving, investing, and potentially seeking professional financial advice. Consistency and patience are key due to the extended time frame.

SMART Goal Framework for Money Management

Achieving your financial goals requires a structured approach. The SMART framework provides a practical method for setting and achieving these goals. SMART stands for Specific, Measurable, Achievable, Relevant, and Time-Bound.

A Specific goal clearly defines what you want to achieve. Instead of “save more money,” a specific goal would be “save $5,000 for a down payment on a car.” A Measurable goal allows you to track your progress. This could involve monitoring your savings account balance regularly or using budgeting apps. Your goal should be Achievable; it needs to be realistic given your income and expenses. An Achievable goal is challenging yet attainable. The goal must be Relevant to your overall financial aspirations and life goals. Finally, a Time-Bound goal includes a deadline. Setting a deadline creates urgency and helps maintain focus.

For example, a SMART financial goal could be: “Save $10,000 (Specific & Measurable) for a down payment on a house within two years (Time-Bound), which aligns with my plan to buy a home in the suburbs (Relevant) and is achievable given my current income and projected savings rate (Achievable).” By following the SMART framework, you increase your chances of successfully reaching your financial objectives.

How to Prioritize Multiple Goals

Achieving multiple financial goals simultaneously requires a strategic approach to prioritization. Prioritization isn’t about abandoning some goals; it’s about sequencing them effectively.

Consider using the Eisenhower Matrix (Urgent/Important). Categorize your goals: Urgent and Important (immediate action), Important but Not Urgent (schedule for later), Urgent but Not Important (delegate or eliminate), and Neither Urgent nor Important (eliminate). This helps focus on what truly matters.

Another effective method involves assigning a numerical value or ranking to each goal based on its importance and impact on your overall financial well-being. Goals with higher scores should be tackled first. Consider factors like time sensitivity, potential return, and risk involved.

SMART goal setting (Specific, Measurable, Achievable, Relevant, Time-bound) is crucial for prioritization. Clearly defined goals make it easier to determine which goals deserve immediate attention and which can be deferred.

Finally, remember flexibility. Life throws curveballs. Be prepared to adjust your priorities as needed, but keep your long-term vision in mind. Regular review and reevaluation are essential for success.

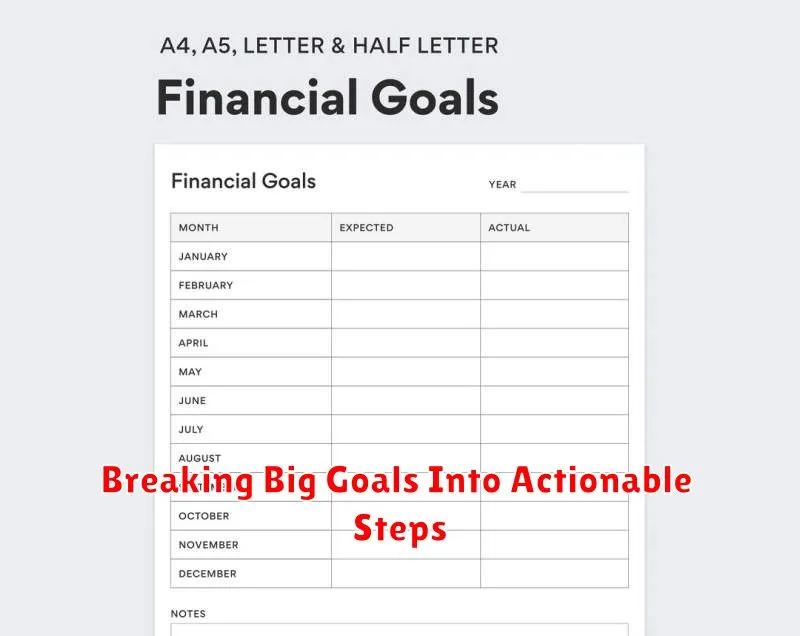

Breaking Big Goals Into Actionable Steps

Achieving significant financial goals, like buying a house or retiring comfortably, often feels overwhelming. The key is to break these large, long-term objectives into smaller, more manageable steps. This makes the overall goal less daunting and provides a sense of accomplishment as you complete each step.

Start by defining your ultimate financial goal clearly and specifically. Then, work backward, identifying the milestones you need to reach along the way. For example, if your goal is to buy a house in five years, break it down into steps like saving a down payment, improving your credit score, and researching mortgage options. Assign realistic timelines to each step.

Make these smaller steps actionable. Instead of simply aiming to “save money,” set specific, measurable targets. For instance, aim to save $500 per month for your down payment. This allows you to track your progress effectively and stay motivated. Regularly review and adjust your plan as needed to account for unforeseen circumstances or changes in your financial situation.

Utilize various tools and resources to support your progress. Budgeting apps can help you track expenses and stay on track with your savings goals. Financial advisors can provide personalized guidance and support in developing a comprehensive plan. Remember, consistency and realistic expectations are key to success.

Tracking Your Progress Effectively

Tracking your progress is crucial for achieving your financial goals. Without monitoring your advancement, it’s easy to lose motivation and stray from your plan. Regularly review your budget and spending habits to ensure you’re on track.

Employ various tracking methods to suit your preference. This could involve using budgeting apps, spreadsheets, or even a simple notebook. The key is consistency; choose a method you’ll stick with.

Celebrate milestones along the way. Acknowledging your achievements, no matter how small, reinforces positive behavior and keeps you motivated. This positive reinforcement is vital for long-term success.

Adjust your strategy as needed. Life throws curveballs. If unforeseen circumstances impact your progress, don’t be discouraged. Re-evaluate your plan and make necessary adjustments to stay on course. Flexibility is key to achieving lasting financial success.

Staying Motivated During Setbacks

Achieving financial goals rarely follows a straight path. Setbacks are inevitable. The key is maintaining motivation despite them.

When faced with a setback, acknowledge your feelings without dwelling on them. Analyze what happened objectively, identifying any controllable factors that contributed to the issue. This allows for learning and improvement, rather than self-blame.

Re-evaluate your goals. Are they still realistic and aligned with your current circumstances? Adjusting your plan based on new information is a sign of strength, not weakness. Break down large goals into smaller, manageable steps for easier tracking and a sense of accomplishment along the way.

Seek support from trusted friends, family, or a financial advisor. Sharing your struggles and celebrating small victories can significantly boost motivation and provide valuable perspectives. Remember that perseverance is key. Your commitment to your financial wellbeing will help you navigate challenges and achieve lasting success.

Celebrating Milestones Without Overspending

Achieving significant life milestones is rewarding, but it’s crucial to celebrate responsibly without derailing your financial progress. Planning is key. Before celebrating, establish a realistic budget for the occasion. Determine how much you can comfortably spend without impacting your savings or debt repayment plans.

Consider alternative celebration ideas that are budget-friendly. Instead of extravagant dinners, perhaps a potluck with friends or a picnic in the park would suffice. Creative activities like homemade gifts or a themed game night can also be incredibly meaningful and cost-effective.

Prioritize experiences over material possessions. Creating lasting memories with loved ones often holds more value than expensive gifts or lavish parties. Focus on the quality of time spent together rather than the monetary cost of the celebration.

Remember, long-term financial health should be a priority. While celebrating accomplishments is important, it shouldn’t come at the expense of your future financial security. By being mindful of your spending and prioritizing experiences, you can celebrate your successes without jeopardizing your financial goals.