Are you a beginner looking to navigate the world of investing? This comprehensive guide, Top Investment Strategies for Beginners, provides essential insights into building a strong financial future. We’ll explore various investment strategies suitable for newcomers, including low-risk options, long-term growth strategies, and the importance of diversification. Learn how to effectively manage risk, understand market trends, and make informed decisions to achieve your financial goals. Discover the power of compound interest and unlock the potential for passive income through smart investing practices. This guide is your starting point for building wealth and securing your financial well-being.

Understanding Different Investment Vehicles

Investing your money wisely requires understanding the various investment vehicles available. Each option carries different levels of risk and potential return. Choosing the right one depends on your financial goals, risk tolerance, and time horizon.

Stocks represent ownership in a company and offer the potential for high growth but also carry significant risk. Bonds, on the other hand, are loans to companies or governments, generally considered less risky than stocks but with lower potential returns.

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets, offering diversification and professional management. Exchange-Traded Funds (ETFs) are similar to mutual funds but trade on stock exchanges like individual stocks, providing greater flexibility.

Real estate involves investing in properties, offering potential for rental income and appreciation but requires significant capital and involves management responsibilities. Retirement accounts, such as 401(k)s and IRAs, offer tax advantages for long-term savings specifically for retirement.

Finally, certificates of deposit (CDs) provide a fixed interest rate for a specific term, offering low risk and a predictable return. It’s crucial to research and understand the characteristics of each investment vehicle before making any investment decisions.

The Power of Compound Interest

Compound interest, often called the “eighth wonder of the world,” is the process where interest earned on an investment is added to the principal amount, and subsequent interest calculations are based on this increased principal. This snowball effect leads to significantly greater returns over time compared to simple interest.

The earlier you start investing and reinvesting your earnings, the more significant the impact of compounding. Even small, consistent contributions can grow exponentially over decades. This is due to the power of exponential growth – your returns earn returns.

To maximize compound interest, focus on long-term investing and avoid withdrawing your earnings prematurely. Choose investments with a history of relatively stable returns, such as index funds or ETFs. While riskier investments can offer higher returns, they also carry a greater chance of losing principal, negating the benefits of compounding.

Understanding and utilizing the power of compound interest is a crucial element of building long-term wealth. Its effects are most powerful over extended periods, making it a cornerstone strategy for beginner investors.

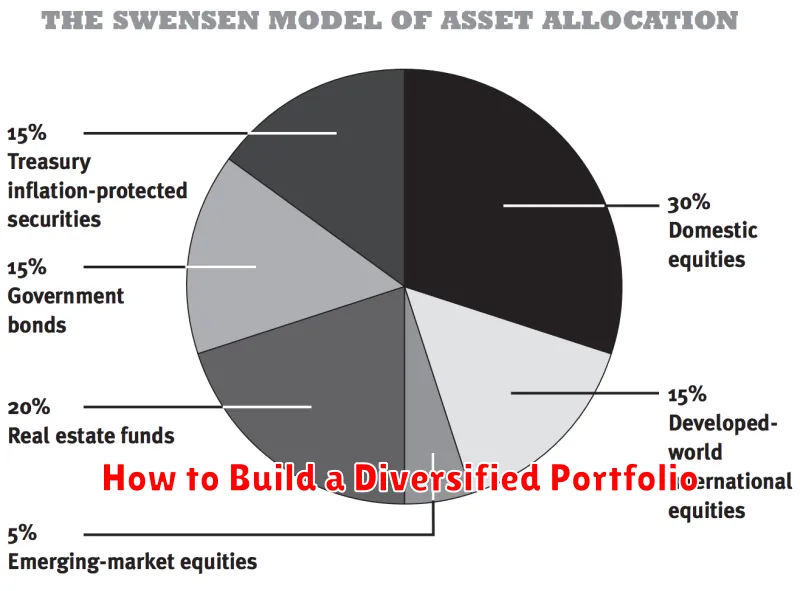

How to Build a Diversified Portfolio

Building a diversified investment portfolio is crucial for mitigating risk and maximizing returns. It involves spreading your investments across different asset classes, reducing your dependence on any single investment’s performance.

A well-diversified portfolio typically includes a mix of stocks, bonds, and potentially other asset classes like real estate or commodities. The specific allocation depends on your individual risk tolerance, investment timeline, and financial goals.

Stocks offer higher growth potential but carry more risk. Bonds provide stability and income but generally offer lower returns. Diversification within each asset class is also important. For example, instead of investing in just one company’s stock, you could invest in a variety of companies across different sectors.

Consider your risk tolerance. Younger investors with a longer time horizon might tolerate more risk and allocate a larger portion of their portfolio to stocks. Older investors closer to retirement might prefer a more conservative approach with a greater emphasis on bonds.

Rebalancing your portfolio periodically is key. As the value of your investments fluctuates, your asset allocation may drift from your target. Rebalancing involves selling some assets that have performed well and buying others that have underperformed, bringing your portfolio back to your desired allocation.

Professional advice can be beneficial, especially for beginners. A financial advisor can help you determine an appropriate asset allocation strategy based on your individual circumstances and goals.

Index Funds vs Individual Stocks

For beginner investors, choosing between index funds and individual stocks represents a crucial initial decision. Each approach offers distinct advantages and disadvantages.

Index funds provide diversified exposure to a broad market segment, minimizing risk through diversification. They are passively managed, requiring less research and time commitment from the investor. However, returns may be less spectacular than those achieved by individual stocks, and investors don’t have the opportunity to select specific companies with high-growth potential.

Investing in individual stocks offers the potential for higher returns if the chosen companies perform well. This strategy, however, demands significantly more research, time, and understanding of financial markets. It also carries a higher risk due to the lack of diversification. A single poorly performing stock can significantly impact the overall portfolio.

Ultimately, the best choice depends on individual risk tolerance, time commitment, and financial goals. Beginners with limited time and a preference for lower risk often find index funds a more suitable starting point. Those with more time, a higher risk tolerance, and a desire for potentially higher returns may consider carefully researching and investing in individual stocks, perhaps after gaining some experience with index funds.

The Importance of Risk Tolerance

Understanding your risk tolerance is paramount before embarking on any investment journey. It dictates the types of investments suitable for your financial situation and personality.

Risk tolerance refers to your comfort level with the potential for investment losses. A high-risk tolerance means you’re comfortable with potentially higher returns alongside greater chances of losses. Conversely, a low-risk tolerance prefers stability and lower returns with minimal risk.

Ignoring your risk tolerance can lead to poor investment decisions. Investing in high-risk ventures when you’re risk-averse may cause undue stress and potential financial hardship. Similarly, a risk-tolerant individual might miss out on potentially higher returns by sticking solely to low-risk options.

Determining your risk tolerance involves self-assessment. Consider your financial goals, time horizon, and emotional response to market fluctuations. Honest self-reflection is crucial for aligning your investments with your personality and financial objectives.

By accurately assessing your risk tolerance, you can build a well-diversified portfolio that matches your needs and goals, leading to a more successful and less stressful investment experience.

Investing for the Long Term

Investing for the long term offers significant advantages, primarily the potential for substantial growth over time. Compounding is a key factor; your returns generate further returns, leading to exponential growth. This approach mitigates the impact of short-term market fluctuations.

Diversification is crucial. Spreading investments across different asset classes (stocks, bonds, real estate, etc.) reduces overall risk. A diversified portfolio helps weather market downturns because not all investments will perform poorly simultaneously.

Dollar-cost averaging is a strategy where you invest a fixed amount of money at regular intervals, regardless of market conditions. This reduces the risk of investing a large sum at a market peak.

Patience is paramount. Long-term investing requires resisting the urge to react to short-term market volatility. Staying invested through market cycles allows your portfolio to recover and grow.

Begin with a clear financial plan outlining your goals, risk tolerance, and investment timeline. Consider seeking advice from a qualified financial advisor to create a personalized strategy.

Mistakes Beginners Should Avoid

One common mistake is emotional investing. Letting fear and greed drive decisions, rather than a well-thought-out plan, often leads to poor outcomes. Avoid impulsive buying or selling based on short-term market fluctuations.

Another frequent error is lack of diversification. Putting all your eggs in one basket exposes you to significant risk. Diversifying your portfolio across different asset classes (stocks, bonds, real estate, etc.) reduces this risk.

Ignoring fees and expenses is also crucial. High fees can significantly eat into your returns over time. Carefully compare the expense ratios of different investment products before making a decision.

Failing to set realistic goals and timelines is a major pitfall. Without a clear understanding of your financial objectives and the timeframe for achieving them, it’s difficult to create an effective investment strategy. Define your goals (retirement, down payment, etc.) and develop a plan to achieve them.

Finally, many beginners make the mistake of not seeking professional advice. While not always necessary, consulting a financial advisor can provide valuable guidance, especially when navigating complex investment options. They can help you create a personalized plan tailored to your individual needs and risk tolerance.

Resources to Learn More About Investing

For beginners, understanding the basics is crucial before diving into specific strategies. Investopedia offers a comprehensive glossary of investment terms and explanations of various financial concepts. Their articles are generally well-written and accessible to newcomers.

Khan Academy provides free courses on finance and investing, covering topics such as risk management, asset allocation, and different investment vehicles. These courses are structured and easy to follow, offering a solid foundation in financial literacy.

Many reputable brokerage firms offer educational resources, including webinars, tutorials, and articles, tailored to their platform and services. These resources can be particularly helpful in understanding how to use their specific tools and execute trades. Always verify their reputation before using their resources.

Finally, consider exploring books on investing for beginners. Look for those with clear explanations and practical advice. Check online reviews to ensure the book is appropriate for your level of understanding. Remember to approach any investment advice with caution and consider consulting a qualified financial advisor before making any decisions.